The following errors have occurred:

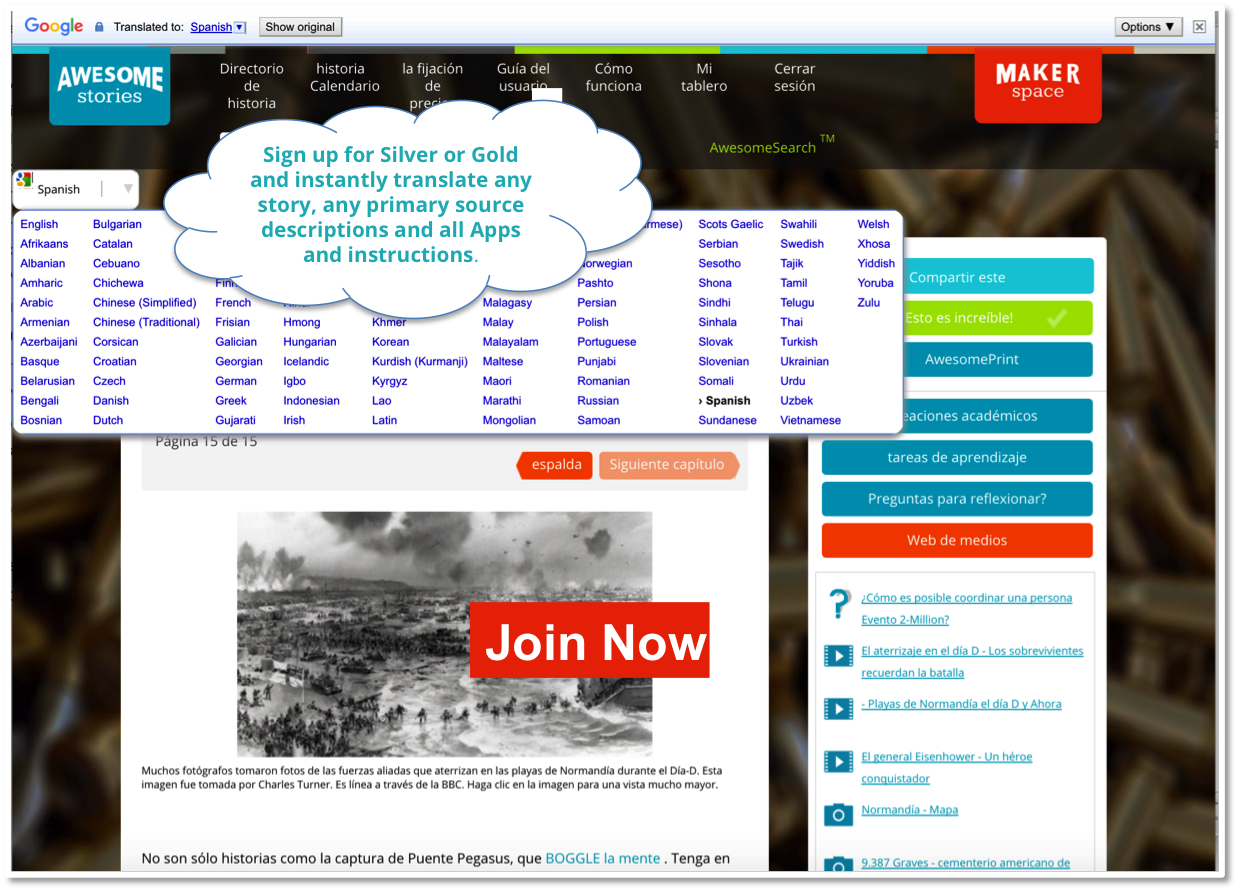

- Please login or signup for a membership to continue enjoying the free trial of AwesomeStories. This is a necessary step to help us communicate new features and stories to our members. Thank you!

Member Login

- OR -